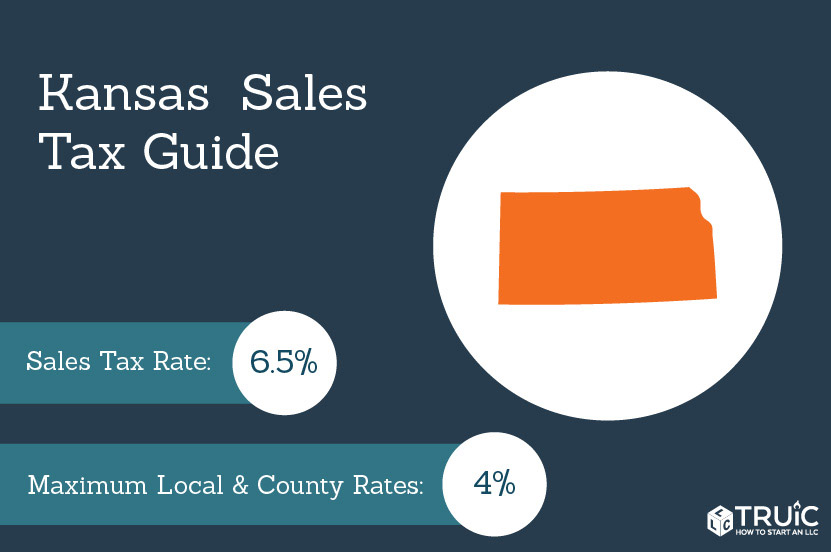

kansas vehicle sales tax rate

The rate ranges from 75 and 106. He earned his law degree in 1979 from the Washburn University School of Law and his Masters of Laws in Taxation degree from the.

Kansas Sales Tax Small Business Guide Truic

Kansas has a 65 sales tax and Wyandotte County collects an additional.

. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kansas local counties cities and special taxation districts. 635 for vehicle 50k or less. There are also local taxes up to 1 which will vary depending on region.

Kansas has a 65 sales tax and Douglas County collects an additional. KANSAS SALES TAX Kansas is one of 45 states plus the District of Columbia that levy a sales and the companion compensating use tax. Code or the jurisdiction name then click Lookup Jurisdiction.

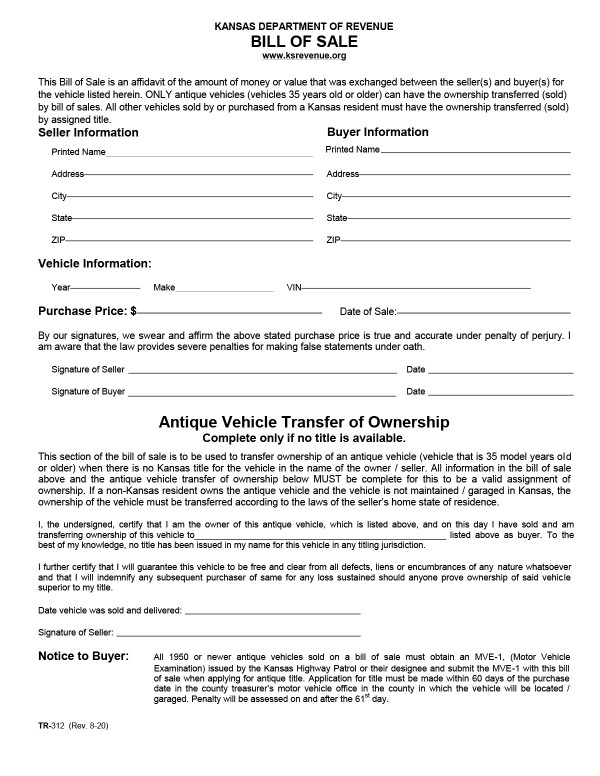

The state sales tax applies for private car sales in Kansas. Renew your vehicle tags online through the Kansas Motor Vehicle Online Renewal System. Burghart is a graduate of the University of Kansas.

Effective July 1 2002 if the vehicle is purchased in a taxing jurisdiction that has a lower. The current state sales tax on car purchases in Missouri is a flat rate of 4225. BACK COVER 3 KANSAS.

Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles. The Kansas Department of Revenue offers this Tax Calculator as a public service to provide payers of Kansas income tax with information to estimate their overall annual Kansas income. That means if you purchase a vehicle in Missouri you will have to pay a minimum of 4225.

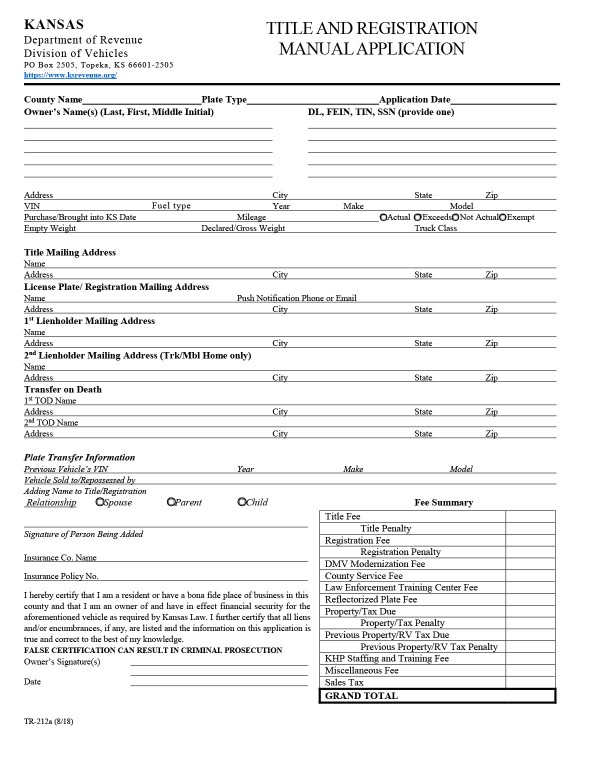

775 for vehicle over. For instance if you purchase a vehicle from a private party for 27000 and you live in a county. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

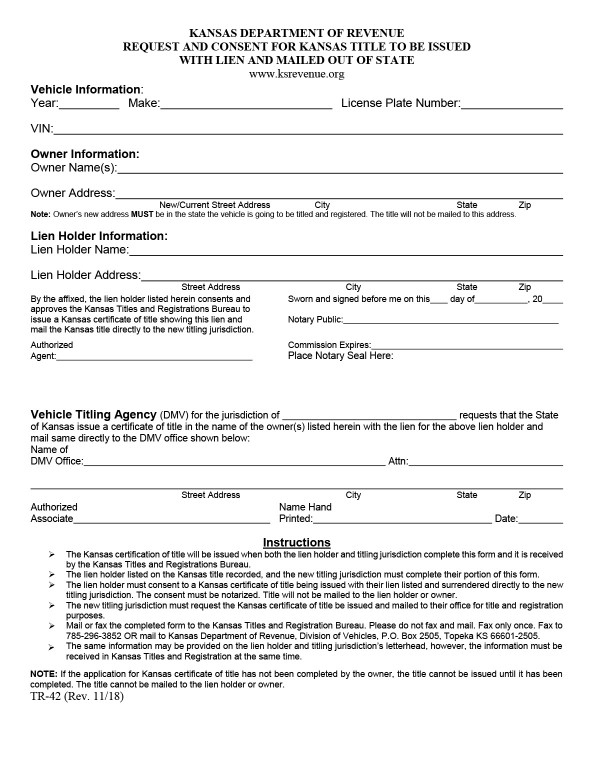

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. You will need your renewal forms sent to you from the Kansas Department of. This publication will address whether sales or compensating use tax is due on a particular vehicle.

Vehicles sold in Kansas are also subject to a local. The total sales tax rate in any given location can be broken down into state county city and special district rates. In addition to taxes car.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Kansas Retailers Sales Tax was enacted in.

Use the Kansas Department of. A sales tax receipt is required if you have purchased the vehicle from a Kansas motor vehicle dealer. Kansas Vehicle Property Tax Check - Estimates Only.

Vehicles purchased outside of Kansas and subsequently registered in Kansas are subject to Kansas Compensating Use Tax. Vehicle property tax is due annually.

Kansas Bill Of Sale How To Transfer Ownership Of Personal Property

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Calculate Auto Registration Fees And Property Taxes Geary County Ks

What S The Car Sales Tax In Each State Find The Best Car Price

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Bill Of Sale How To Transfer Ownership Of Personal Property

State Corporate Income Tax Rates And Brackets Tax Foundation

Kansas Bill Of Sale How To Transfer Ownership Of Personal Property

Kansas Bill Of Sale How To Transfer Ownership Of Personal Property

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax On Cars And Vehicles In Kansas

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Kansas Vehicle Sales Tax Fees Find The Best Car Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation